『NEXCO東日本グループ中期経営計画(平成29~32年度)』を策定しました

~平成32年度までの4年間、将来のありたい姿を実現するために挑戦し、飛躍します~

平成29年4月27日

東日本高速道路株式会社

NEXCO東日本(東京都千代田区)は、このたび『NEXCO東日本グループ中期経営計画(平成29~32年度)』を策定しました。

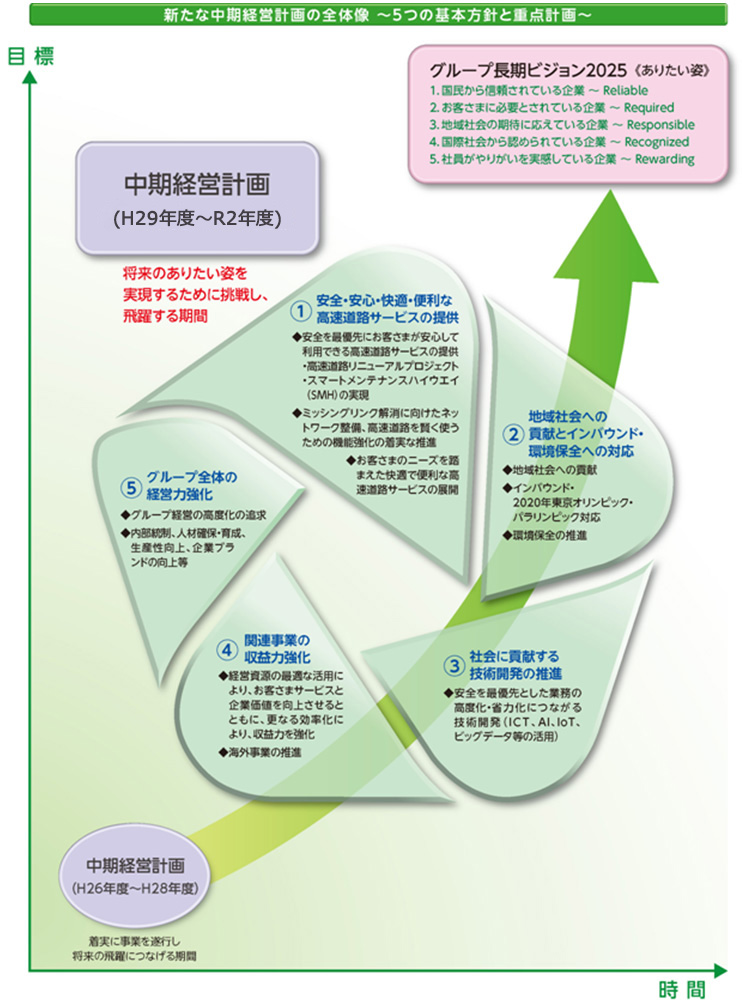

本計画では、平成32年度(2020年度)までの4年間を「将来のありたい姿を実現するために挑戦し、飛躍する期間」と位置づけています。NEXCO東日本グループは、社会的使命を果たすための5つの基本方針をもとに、グループ経営ビジョンで掲げた、「つなぐ」価値を創造し、あらゆるステークホルダーに貢献する企業として成長することを目指し、グループ一体となってこの計画を推進していきます。

NEXCO東日本グループ中期経営計画(平成29~32年度)のポイント

1.中期経営計画の全体像

2.中期経営計画の主な財務計数計画

(1)高速道路事業

1)損益計画

| H29~H32年度累計※ | |

|---|---|

| 料金収入 | 約2兆8000億円 |

| 道路資産賃借料 | 約2兆0000億円 |

| 管理費等 | 約8000億円 |

- H29.3.31に高速道路機構と締結(変更)した協定の計画値

2)投資計画

| 資産区分 | H29~H32累計額 | 主な投資内容 |

|---|---|---|

| 機構資産※1 | 約2兆0000億円※2 | 高速道路の新設・改築 特定更新・修繕事業 等 |

| 会社資産 | 約1,300億円 | 料金収受機械、ETC設備の整備、老朽化更新 等 |

- 機構資産とは完成後に高速道路機構へ引き渡すこととしている道路資産

- H29.3.31に高速道路機構と締結(変更)した協定の計画値

(2)関連事業

1)損益計画

| H28年度通期見込※ | H32年度計画 | |

|---|---|---|

| 営業利益(連結) | 12億円 | 40億円 |

- H28年度通期見込は、「平成28年度中間決算の概要」(H28.12.20公表)のもの。

2)投資計画

| 資産区分 | H29~H32累計額※ | 主な投資内容 |

|---|---|---|

| 会社資産 | 約480億円 | 商業施設の新設・増改築・老朽化更新 等 技術センター(仮称)整備、システムのリプレース等 |

- 事業共用分を含む。

参考資料

PDFファイルをご覧いただくには、AdobeSystems社のプラグインソフト「Acrobat Reader(日本語版)」が必要です。お持ちでない方は、こちらからダウンロード(無料)してご利用ください。

関連サイト・コンテンツ

料金・ルート検索、サービスエリア・パーキングエリアの情報をお探しの方はこちら。

リアルタイムの渋滞・規制情報をお探しの方はこちら。

災害時の通行止めなどの道路情報をお探しの方はこちら。